defer capital gains taxes indefinitely

There are specific rules and. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be.

Short Term Vs Long Term Capital Gains White Coat Investor

Or you can even withdraw the entire amount and pay the capital.

. The capital gains will eventually be taxed when that property is sold or will be deferred again. The 1031 Exchange is named because. It creates economic inefficiencies through a lock-in effectencouraging wealthy people to hold assets indefinitely.

This is where a swap or 1031 exchange can save your day. While investing in real estate through the buying and selling of property can be a lucrative endeavor in order for an investor. The ability to defer taxes on capital gains is a large benefit.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. At any time you can choose to alter your payment structure. But the problem with a sale of an investment property are those huge taxes which often take a big bite out of your proceeds.

The DST defers capital gains and other taxation on the sale. If you sell your business or property to the deferred sales trust you will be able to defer your capital gains tax indefinitely depending on how much principle money remains. The plan would eliminate billionaires ability to defer capital-gains taxes indefinitely and it would impose multibillion-dollar tax bills on people such as Jeff Bezos and.

Learn the Nexxess Strategy of the super wealthy and see how you too can defer this tax indefinitely. Ad If youre one of the millions of Americans who invested in stocks. By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property.

You have the freedom to defer your capital gains tax indefinitely. This deferral can be for as long as the. Assets can be swapped until death and.

By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property. When you sell your business or property to the deferred sales trust you can defer your capital gains tax indefinitely by keeping the principle amount from your sale invested. If you invest that 250000 gain in.

How to Defer Tax on Capital Gains Tax-Deferred Exchange. Learn the Nexxess Strategy of the super wealthy and see how you too can defer this tax indefinitely. Many savvy investors use this to multiply their returns and defer capital gains tax on the sale of their real estate investments indefinitely.

With a 1031 exchange you can defer capital gains taxes indefinitely if you keep reinvesting in other like kind or similar rental properties. Defer Capital Gain and Depreciation Recapture Taxes Indefinitely. While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a.

As long as you. The DST bridges the gap between selling the property and sheltering the capital gains from it.

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

Deferred Sales Trust Max Cap Financial

Ways To Potentially Defer Capital Gains Tax On Stocks

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

How Capital Gains Affect Your Taxes H R Block

Short Term Vs Long Term Capital Gains White Coat Investor

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

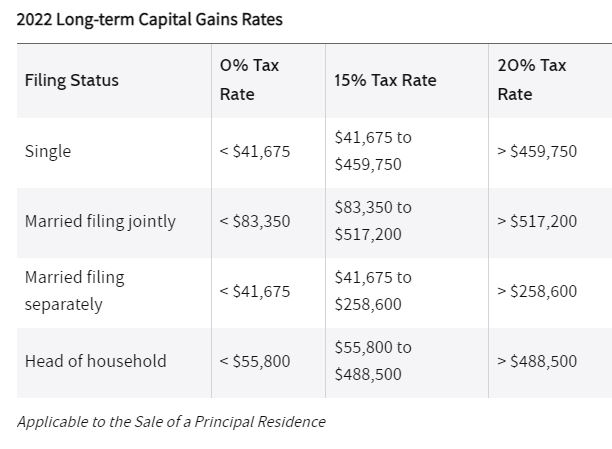

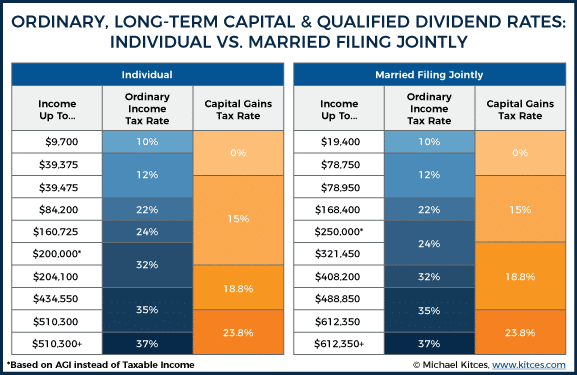

High Class Problem Large Realized Capital Gains Montag Wealth

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax In The United States Wikiwand

Capital Gain On Sum Received By Assessee Pursuant To A Development Agreement Refunded Later On Capital Gain Development Sum

Capital Gains Taxes White Coat Investor

Capital Gains Full Report Tax Policy Center

Exit 01 How To Reduce Capital Gains Taxes On Real Estate With Passive Losses Tax Loss Harvesting

High Class Problem Large Realized Capital Gains Montag Wealth