rsu tax rate uk

In reality the difference is the RSU Taxes left. RSU Taxation For Non-US.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Well send you a link to a feedback form.

. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. At this point the employee is charged to income tax on 30. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would.

Here is an article on employee stock options. The value of over 1 million will be taxed at 37. Picnics goal is to make tax filing simpler and painless for everyday Americans.

Because there is no actual stock issued at grant no Section 83 b election is permitted. Net RSU Value Before Employer Income Tax NI. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part.

Hi can I just check please the circumstances here - I am UK tax resident working for the UK sub of a US parent company and have RSUs in the parent that have vested this year. Here is the information you need to know prior to jumping in. 10000 options 30 fair market value less 10000 options 1 strike price 290000.

Plus Basic Rate tax relief on pension contribution. Deducting employers NIC 138 3450. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee.

If RSUs are awarded to non-UK residents eg. Your restricted stock units shall become null and void if you do not execute and return the joint election form to your employer or to EA. Residual Value After All Tax.

Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industrys leading firms. Tax Implications of Restricted Stock Units. Acquiring RSUs RSUs are not taxable when they are granted.

If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

Less 40 Income Tax 40 Higher Rate Tax no lost personal allowance-6896. Income and social taxes are based on the value of the shares at the time of delivery not grant and capital gains tax applies to the eventual sale of the shares. Most companies will withhold federal income taxes at a flat rate of 22.

At any rate RSUs are seen as supplemental income. The amount subject to income tax and national insurance is 290000. If the employee received the RSU for free the employment tax charge would be 80.

Currently employers NICs are charged at a rate of 128. Salary 100000 RSU Value 25000. The loss from the sale of shares can be carried forward up to 5 years.

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Taxation of RSUs. How Are Restricted Stock Units RSUs Taxed.

On their UK payslip last one of the year it shows their final salary and the total RSU and RSU taxes as income then the total RSU as dedcuted. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Outside the US for employees in other countries the timing of taxation for restricted stock units is similar.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. On the restriction lifting the share is now worth 200. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

RSU Taxes Explained. 50 Tax and NIC paid. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

Extra tax of 4310 due to loss of personal allowance as income above 100000. Less National Insurance 2-345. Income tax 40 of Remaining 8620.

Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. Employee total salary before RSU is 100000. RSUs Restricted Stock Units are a big part.

Willie is charged to tax on the total of moneys worth received of 4500 and cash earnings of 450 at vesting making a total charge on 4950 Top of page Example 4 - RSU with dividend. Restricted Stock Units RSUs Tax Calculator. Will determine the correct tax treatment.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. However Jane may decide to. Because the RSUs pushes your total income above 100000 you will pay 60 income tax on the RSUs.

I have a client who worked abroad and moved to the the UK and had their RSUs vested when they moved to the UK. This is known as the 60 tax trap. Restricted stock units RSU.

To accomplish the foregoing you will be asked to execute a joint election to assume the employers NICs. RSU on self assessment. Internationally mobile employees then the tax treatment may be different from what was expected and clients should speak to one of the Reed Smith.

Again shares were withheld to pay for the taxNI liability. To help us improve GOVUK wed like to know more about your visit today. There are various occasions when RSUs may attract taxes in the UK when owned by someone who is UK tax resident and reporting the taxation which is not handled by the employer can be a minefield especially if shares have been held for a while before being sold.

Total Tax and NIC 10000. Net pay 10000. RSUs can also be subject to capital.

For every 2 you earn above 100000 your Personal Allowance is reduced by 1.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Tax Rate Is Exactly The Same As Your Paycheck

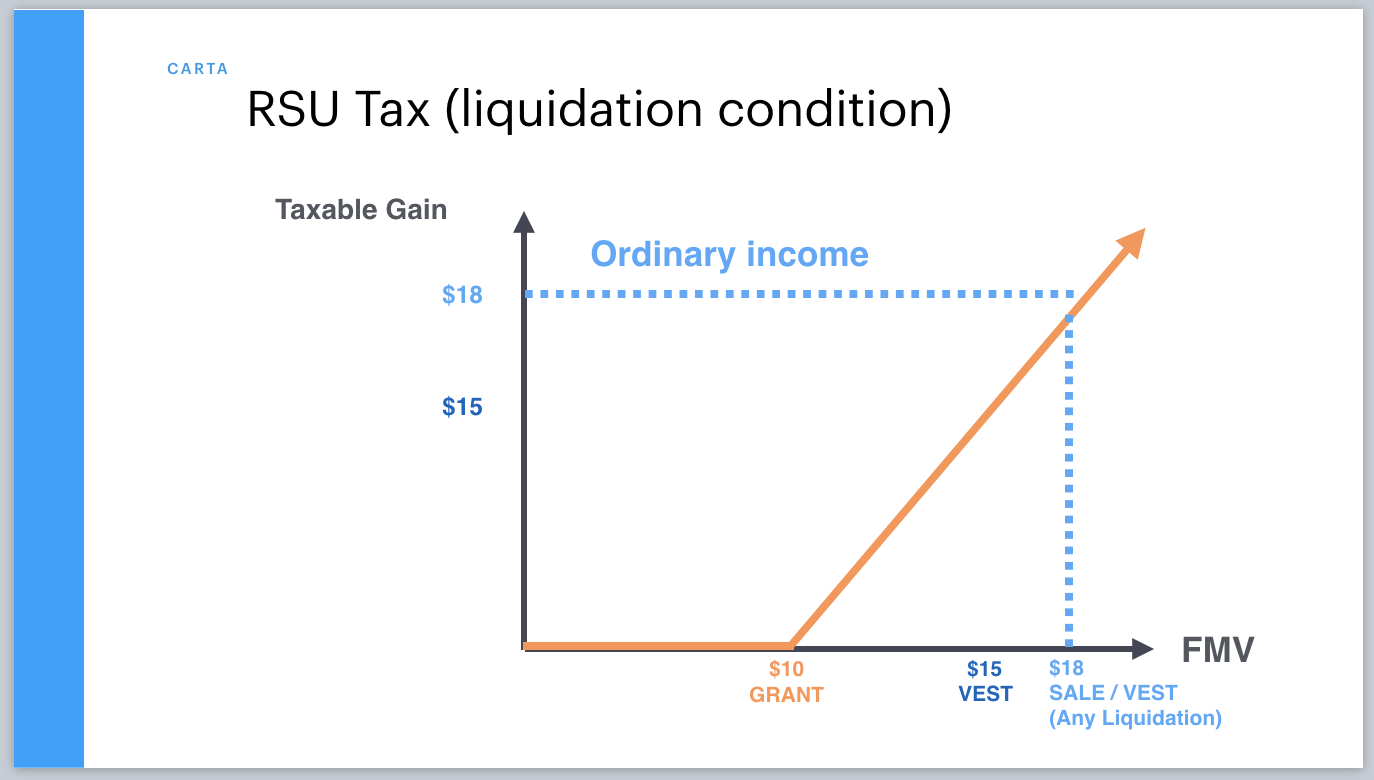

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta